Credit Union Cheyenne WY: Comprehensive Financial Providers for Citizens

Credit Union Cheyenne WY: Comprehensive Financial Providers for Citizens

Blog Article

Discover the Benefits of Lending Institution Today

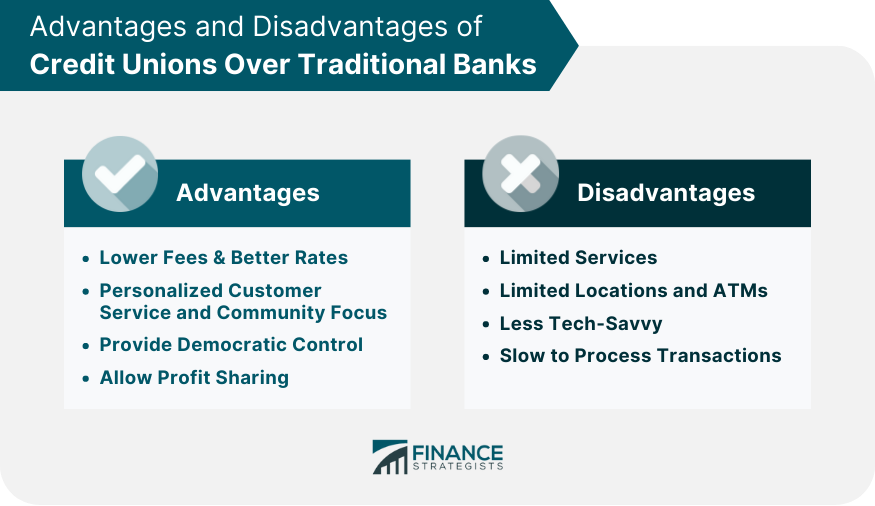

Lending institution stick out for their special method to monetary solutions, supplying a distinct collection of advantages that provide to their members' requirements in such a way that typical financial institutions typically battle to match. From tailored client service to competitive interest rates and a community-focused method, cooperative credit union provide a compelling alternative for people looking for more than simply the common financial experience. By checking out the benefits of cooperative credit union even more, one can find a financial establishment that prioritizes its participants' monetary wellness and intends to construct lasting partnerships based upon count on and support.

Membership Benefits

Subscription advantages at credit scores unions encompass a spectrum of financial benefits and solutions tailored to foster participant success and wellness - Credit Union Cheyenne. One considerable advantage of debt union membership is the customized customer solution that participants get.

Additionally, credit rating unions often give access to reduced rate of interest prices on financings, higher rates of interest on savings accounts, and lowered fees contrasted to larger financial organizations. Participants can make the most of these positive rates to save cash on finances or grow their savings extra properly. In addition, cooperative credit union typically use a range of monetary products and solutions, such as credit rating cards, home mortgages, and pension, all developed to meet the varied needs of their participants.

Reduced Costs and Better Rates

Lending institution stand out for their commitment to providing lower costs and better rates, lining up with their mission to offer members monetary advantages that conventional financial institutions may not focus on. Unlike financial institutions that aim to maximize profits for shareholders, credit unions are not-for-profit organizations had by their members. This framework enables lending institution to concentrate on offering their members' ideal passions, leading to lower fees for solutions such as checking accounts, car loans, and bank card. Additionally, lending institution typically provide a lot more competitive rates of interest on financial savings accounts and car loans contrasted to typical financial institutions. By keeping fees low and rates competitive, cooperative credit union help participants conserve cash and attain their financial goals a lot more successfully. Participants can gain from decreased costs on essential economic services while earning higher returns on their deposits, making cooperative credit union a recommended choice for those seeking affordable and advantageous economic options.

Area Participation and Support

Active area participation and assistance are essential aspects of cooperative credit union' procedures, showcasing their commitment to cultivating regional connections and making a favorable effect past financial solutions. Unlike traditional banks, credit score unions focus on neighborhood interaction by proactively taking part in neighborhood events, supporting philanthropic causes, and offering monetary education programs. By being deeply embedded in the areas they offer, cooperative credit union show a real dedication to improving the well-being of their members and the areas in which they run.

With efforts such as volunteering, sponsoring neighborhood occasions, and supplying scholarships, cooperative credit union develop themselves as columns of assistance for regional residents. This active involvement surpasses just supplying economic services; it creates a feeling of belonging and solidarity amongst participants. Additionally, cooperative credit union commonly team up with various other regional organizations and organizations to resolve area demands successfully. By cultivating these solid community ties, lending institution not only improve their reputation but also add to the general development and success of the areas they serve.

Personalized Financial Solutions

With an emphasis on meeting the special financial requirements of their members, credit unions use individualized economic solutions customized to individual scenarios and goals. Unlike conventional financial institutions, cooperative credit union prioritize developing relationships with their participants to comprehend their details monetary scenarios. This tailored technique permits cooperative credit union to supply tailored services that align with members' long-term objectives.

Credit history unions give visit their website a variety of customized monetary solutions, consisting of personalized monetary appointments, customized loan products, and individualized financial investment suggestions. By putting in the time to understand each member's financial goals, credit score unions can offer pertinent and targeted advice to help them attain economic success.

Moreover, cooperative credit union typically offer personalized budgeting aid and financial planning devices to assist participants manage their cash efficiently. These sources equip participants to make educated monetary decisions and work towards their desired financial outcomes.

Enhanced Client Service

In the world of monetary establishments, the provision of remarkable customer support sets debt unions in addition to various other entities in the market. Credit score unions are understood for their devotion to putting members initially, supplying an extra individualized approach to customer care contrasted to conventional banks. Among the crucial advantages of lending institution is the improved level of client service they supply. Participants often have direct access to decision-makers, permitting quicker reactions to questions and an extra customized experience.

Moreover, credit scores unions generally have a solid concentrate on structure partnerships with their participants, aiming to understand their distinct economic demands and objectives. This customized attention can lead to better economic suggestions and preferable product recommendations. In addition, lending institution staff are usually applauded for their kindness, desire to assist, and general dedication to participant complete satisfaction.

Verdict

To conclude, lending institution provide a series of benefits including customized customer care, lower charges, much better rates, and neighborhood participation. By prioritizing participant complete satisfaction and monetary wellness, credit rating unions concentrate on serving their members' benefits and assisting them accomplish their monetary goals effectively. With a commitment to offering competitive prices and personalized economic services, cooperative credit union proceed to be a reliable and customer-focused choice for people seeking economic assistance.

By discovering the benefits of debt unions better, one can uncover a monetary establishment that prioritizes its members' monetary health and aims to construct long-term connections based on depend on and assistance.

Credit history unions typically use a selection of economic items and check my source services, such as credit scores cards, mortgages, and retirement accounts, all made to satisfy the diverse demands of their participants. - Credit Union in Cheyenne Wyoming

With a focus on meeting the distinct economic requirements of their members, credit history unions offer customized economic solutions tailored to private scenarios and goals. By focusing on member contentment and monetary health, credit report unions concentrate on offering their members' best passions and helping them achieve their economic goals successfully.

Report this page